By Lyric Waiwiri-Smith

Copyright thespinoff

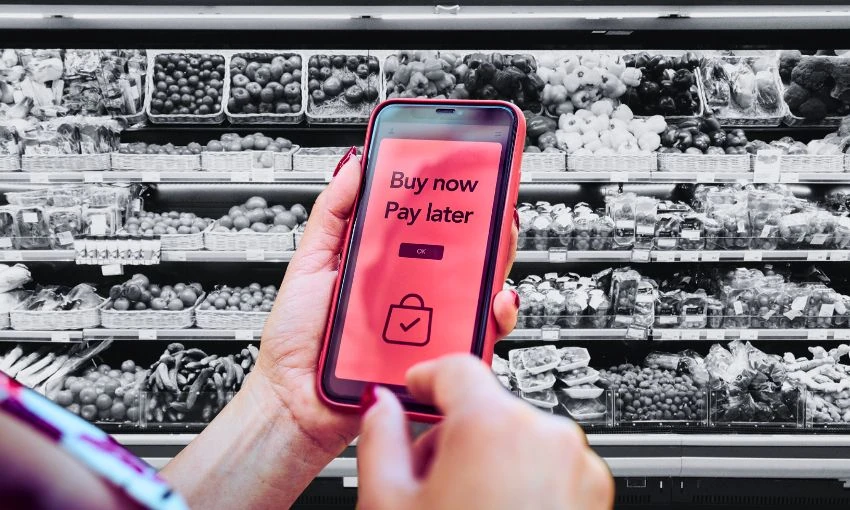

The buy now, pay later lender stopped allowing no upfront payments on essentials in order to ‘promote responsible spending’. Seven months later, the policy has been reversed, and financial mentors are worried.

In March, amid concerns about struggling families racking up mountains of debt using buy now, pay later (BNPL) schemes to pay for essentials, Afterpay stopped allowing “no payment upfront” on grocery and fuel purchases. It was all part of its commitment to “enhancing customer choice and flexibility while promoting responsible spending”, the Australian lender told Stuff in February. “We believe these adjustments will help our customers manage their spending more effectively while maintaining the flexibility and convenience they expect from Afterpay.”

This week, there was a quiet backtrack: Afterpay account holders were sent an email telling them they could once again make fuel and grocery purchases under $500 without paying anything upfront. First payment instalments for these purchases are due within eight to 14 days, and can be made with merchants such as Z Energy, Caltex, Mad Butcher and Farro, said the email. (New Zealand’s biggest supermarkets, New World and Woolworths, offer the Swedish-founded BNPL service Klarna, which requires a small first payment at the checkout.)

In a response to questions from The Spinoff, Afterpay said the reversal of the policy comes as the company “evolv[es] based on customer feedback and strong merchant partnerships”, and that the new (old) system will still encourage consumers to be “spending responsibly”.

“The reintroduction of ‘no payment upfront’ for fuel and groceries gives customers greater flexibility, while maintaining our commitment to responsible lending,” the statement read. “Using Afterpay for everyday spending is now mainstream, and by enabling this feature through our trusted merchant network, we’re meeting customer demand with safeguards in place.”

Financial mentoring charity FinCap has been monitoring the BNPL industry alongside Consumer NZ, and its senior policy adviser Jake Lilley told The Spinoff the charity had been alerted to Afterpay’s policy change by its clients. “Our initial reaction is just worry that people will end up trapped, unable to pay for food in the coming weeks as Afterpay loans get in the way,” Lilley said. “People don’t often see it as a debt, they see it more like an overdraft or transaction tool, but it can really catch up to people when they’re cutting back on meals to pay the creditor first.”

There have long been concerns that BNPL schemes prey on the poorest consumers. In 2022, Consumer NZ research found that 50% of households with incomes below $50,000 had resorted to the use of BNPL for essential products, much higher than wealthier households, and they were also much more likely to have been charged late or missed payment fees. Afterpay charges late fees up to a maximum of 25% of the order total or $68.

Since September 2024, because of a decision made by the previous Labour government, BNPL lenders have been expected to comply with the Credit Contracts and Consumer Finance Act (CCCFA) and the Credit Contracts and Consumer Finance Regulations 2023 (CCCFR). Under the CCCFA, agreements with BNPL lenders are considered credit contracts, meaning they’re subject to obligations like responsible lending (lenders are expected to not induce consumers using “oppressive” means). It also means that borrowers who are undergoing hardship can apply to change their payment contract, and borrowers are also protected under the Fair Trading Act.

But after intervention by David Seymour’s Ministry of Regulation, Cabinet agreed to exempt BNPL lenders from consumer protections that would prevent them from charging “unreasonable” credit or default fees, meaning they could charge fees that would be deemed unlawful if they were being charged by banks or other lenders. In a Cabinet paper, then commerce and consumer affairs minister Andrew Bayly warned that leaving these fees unregulated “would not provide any consumer protections against excessive default fees”.

BNPL schemes are also exempt from affordability and suitability assessments – whereby traditional lenders must take reasonable steps to ensure the borrower will be able to repay the loan without undue hardship – as long as they clearly disclose their terms at the point of sale and engage in credit reporting (the gathering and sale of individual credit histories to assess creditworthiness). A regulatory impact statement for this decision found that while financial mentors and charities should be fully regulated under the CCCFA, BNPL lenders argued that regulations such as affordability assessments would be “disproportionate for small amounts of interest-free credit”. The report noted that should this exemption be ineffective at reducing financial hardship, “additional regulation could be applied if further analysis supports this”.

There’s also no specific requirement in the CCCFA nor the CCCFR as to how lenders structure their pay instalments (whether that asks for an upfront payment now, or one in 30 days), as long as they clearly state when payments are due.

FinCap’s Lilley said the most worrying aspect of BNPL contracts was the exemption from affordability assessments, which ensure lenders aren’t “dooming someone into something that’s unaffordable from the start”. “Having them fully covered under the credit law would bring relief here … That would have checked that you’re not getting into an unaffordable loan at the start, and give you some rights to push back on if you’re being debt-collected.”

However, BNPL lenders often offer more support to borrowers than other creditors, said Lilley, giving the example of a telco that might entice you into buying the latest iPhone on a months-long interest-free loan. “You get a sales pitch, and it gets to a point where people are spending so much money on having a phone, when they could get something cheaper and now can’t exit [a contract],” he said. “The marketing can really push you when you’re in a bind to make quick decisions, and we’re looking at getting the laws changed so that you’re not trapped if the rush gets to you.”

Lilley said FinCap would release phase two of its report on reforms in the BNPL industry in the coming months.

Minister for commerce and consumer affairs Scott Simpson told The Spinoff that Afterpay’s “no upfront payments” decision was “Afterpay’s call as a private business”, and that BNPL schemes “are already covered under our consumer credit laws, so people using them get many of the same protections as they would with things like credit cards or personal loans”.

“If anyone’s worried, the Commerce Commission is the best place to raise concerns,” he said.