For decades, small company owners hoping to move their business or expand it to a mall were confounded by a lack of available space, or prohibitively high rents for empty storefronts. Now, as the number of big box and restaurant chains pulling out of those locations increases, the entrepreneurs that want to set up shop in shopping centers once reserved for giants like JCPenny, Macy’s, and Starbucks are finding mall vacancies in many parts of the U.S. — and at times paying lower per-foot rents than those corporate giants.

The list of large companies that have gone bankrupt or closed numerous stores in 2025 has been long, and includes craft chain Joann, Party City, Kohl’s, Big Lots, Claire’s, Dick’s Sporting Goods, and many more. While not all the big retailers and food businesses shuttering outlets have been based exclusively in malls, many maintain sizable footprints in U.S. shopping centers — including Starbucks, which last week announced hundreds of location closures. The subsequent slump in occupancy rates at many malls is now allows many smaller businesses to set up shop in them for the first time.

A recent study by commercial real estate company Cushman & Wakefield estimated the national vacancy rate in malls at 5.8 percent in the second quarter of 2025. While that may not sound high, it represented a 20 basis point increase over Q1, and a 50 point hike since the same period in 2024. That evolution is now leading many owners or managers of underoccupied shopping centers to rethink their earlier aversion to renting to smaller businesses, whose lower cash reserves often prevent them from taking on assured, long-term leases.

Instead, according to a recent report by CNBC, entrepreneurs are not only finding vacant space in malls available to rent. But they’re often also negotiating considerable deals on rent rates, business set up assistance, continual occupancy services, and shorter lease durations from owners. Some shopping centers set aside space for smaller businesses on more flexible terms, in hopes of converting them to longer-term leases, according to ICSC, a trade association of shopping center owners. Not surprisingly, more entrepreneurs want o seize those opportunities to move into shopping centers.

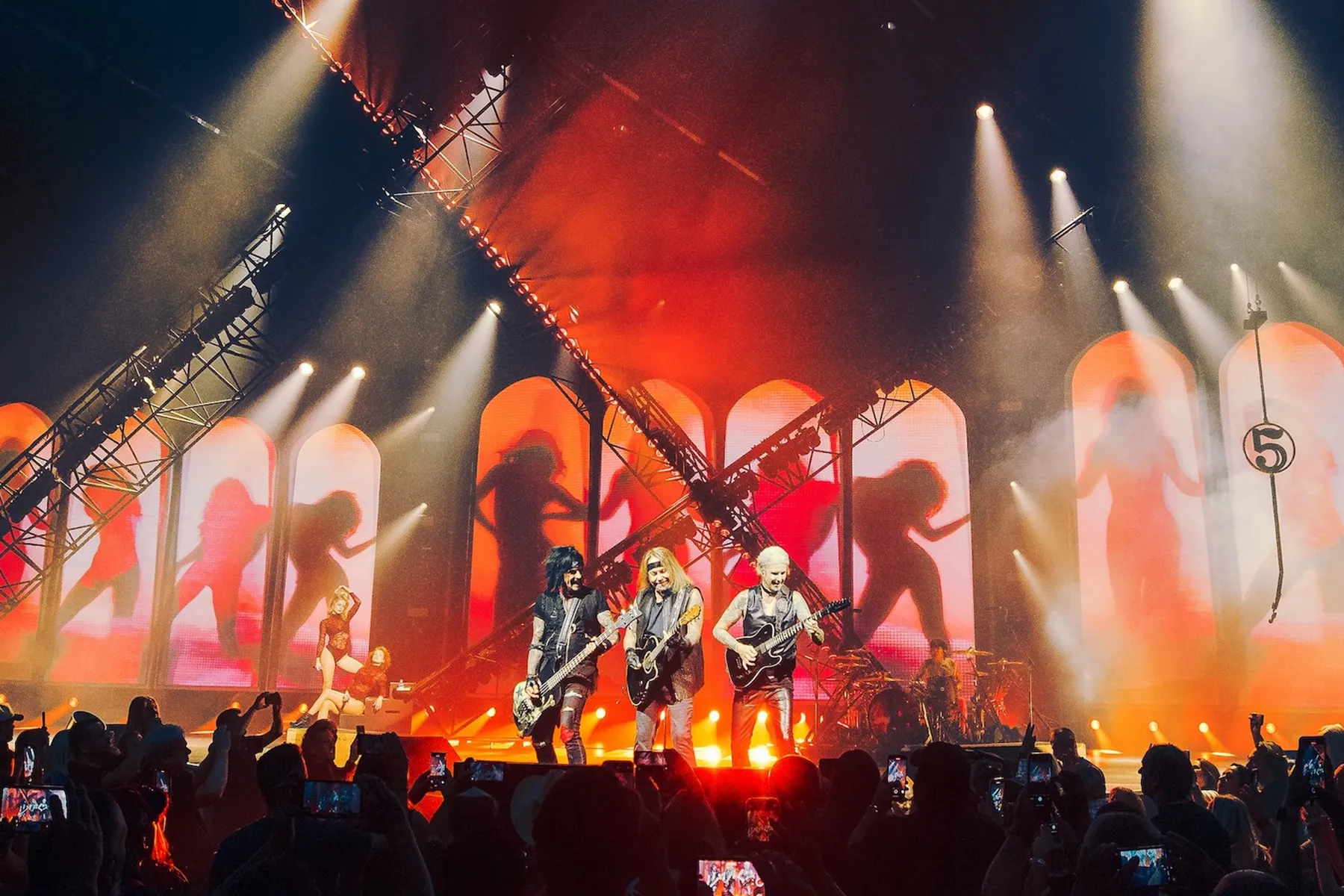

Featured Video

An Inc.com Featured Presentation

“That kind of access wasn’t on the table for startups and small businesses three years ago in most metro areas,” Teresha Aird, co-founder and chief marketing officer of the Offices.net real estate brokerage, told the business news channel. “Now it is, and they’re making the most of it to test physical presence without overextending capital… The result is a more flexible, opportunity-rich environment that can be a lifeline for entrepreneurs navigating tight margins and competitive markets.”

The new opportunities for smaller businesses to rent mall space aren’t evenly spread across the country. For example, experts note that availability of nearly any commercial space in the New York City area is so tight that even converted warehouses are tough to lease. But many major U.S. urban centers — especially in medium-sized city centers and inner-ring suburbs of larger cities where big retailers have shut stores — the chances for entrepreneurs to move in on malls are multiplying.

To be sure, some shopping center owners continue betting they have more to gain by waiting for big box, anchor tenant occupants. Rather than renting to entrepreneurs with smaller budget looking for shorter leases at lower costs, many mall managers hold out for so-called “credit tenants” with large enough reserves to sign 5- to 7-year contracts at full market rates.

But an increasing number of mall landlords are feeling enough pressure on their vacancy rates and revenue that they’re now looking to rent to small businesses — even some pop-up stores. Many are even adding sweeteners to bring entrepreneurs aboard.

“In West Des Moines, a family-owned restaurant recently assumed an old chain pizzeria location at a rent of almost 30 percent below the original asking rent,” local real estate broker Jacob Naig told CNBC — adding the owner helped finance the kitchen redesign. “Such a deal wouldn’t have been possible just five years ago.”

There also may be another factor at work in the small business migration to malls. According to a recent study by location intelligence and foot traffic data company Placer.ai, small and niche retail and food companies are helping transform the entire shopping mall experience.

That involves giving consumers used to swooping in for fast, targeted buying blasts reasons to stay longer. Former single-store visitors to malls may now also get medical or wellness treatment, go to the gym, see local service providers, take in a spa, and enjoy a fancier meal than typical food court businesses usually offer.

As part of that, entrepreneurs can take over prime locations that national chains gave up, and add local, quality goods, meals, and services that effectively rebrand some malls. At the same time, they benefit from the work of former corporate occupants, who previously researched and identified those spaces as good for business.

“These spaces already had a site selection review, foot traffic, and locals are used to seeing activity in the space,” said entrepreneur Andy LaPointe, the owner of Michigan gourmet food company Traverse Bay Farms, who told CNBC he now operates locations in two strip malls. “But the magic happens when a small business brings, not a cookie-cutter replacement, but something unique, a place to linger and a sense of belonging… So when a national chain leaves a space, it isn’t just a gap, it’s a canvas for a small, local business to create something lasting.”