For nearly a decade, silver miners have lived in the shadows of the very metal they dig from the ground. While silver itself has enjoyed periodic rallies and endured inevitable sell-offs, junior mining equities—the speculative small-cap explorers and producers represented by the SILJ ETF—have consistently lagged.

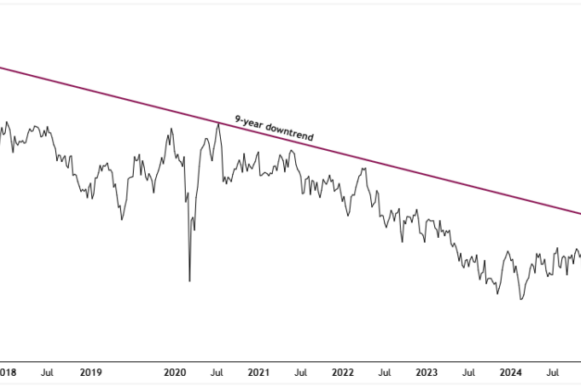

That lag became undeniable between 2016 and 2025. The SILJ/Silver ratio, which tracks the relative performance of silver miners against the spot price of silver, carved out a relentless pattern of lower highs and lower lows. For investors, the ratio told a discouraging story: nine straight years of underperformance that pushed mining stocks out of favor and, in many cases, out of portfolios entirely.

Yet markets never move in one direction forever. Technical structures eventually exhaust themselves, sentiment overshoots to extremes, and conditions ripen for a reversal. That cyclical reality is now reasserting itself. Today, the chart of the SILJ/Silver ratio is no longer signaling weakness; it’s flashing unmistakable signals that the tide has finally turned.

The clearest of these signals is the decisive break of its 9-year downtrend, a level that had acted as a ceiling for nearly a decade. Adding conviction to this shift, a bullish moving average crossover has confirmed the trend reversal. Taken together, these developments suggest that after years in the wilderness, silver equities are not merely recovering lost ground; they are preparing to lead silver bullion into the next phase of the cycle.

With this structural change underway, the key question becomes: what makes this breakout different from the many false starts of the past? To answer that, we need to examine the technical signals, historical precedents, and broader market forces that are now aligning in favor of silver miners.

Breaking Free From the Shackles of a 9-Year Downtrend

Since 2016, the defining feature of the SILJ/Silver ratio has been its relentless decline. Every rally attempt stalled at the same descending resistance line, a technical ceiling that consistently capped miner outperformance. Over time, each rejection hardened the perception that owning silver itself was safer and more rewarding than taking the added risk of betting on the equities.

That long-standing narrative finally cracked in September 2025, when the ratio pushed decisively above its 9-year trendline. Such downtrend lines are not just technical curiosities; they mark entrenched supply zones where rallies typically fail and sentiment deteriorates. When they are finally broken, it signals a structural shift in the underlying cycle.

Notably, this breakout did not occur in isolation. It unfolded just as silver itself was entering a new bull phase, powered by rising industrial demand, a weakening U.S. dollar, and a wave of renewed capital rotation into commodities. In other words, miners are not only breaking out technically, but they are doing so at a moment when the fundamental backdrop is aligning in their favor. And that convergence makes this move far more compelling than the failed rallies of the past.

Golden Cross Confirms the End of a Bear Cycle

If the 9-year downtrend breakout were the only signal, it would already mark a significant technical development. But the case for silver miners grows even stronger when paired with a second, equally powerful confirmation: the appearance of a golden cross.

This signal occurs when the 26-week simple moving average (SMA)—a measure of medium-term momentum—crosses above the 104-week SMA, which represents the longer-term trend. Such events are relatively rare, and when they do appear, they often coincide with transitions from prolonged bear cycles into new bull phases. On a weekly timeframe, the significance only increases, as the signal filters out the daily volatility that can obscure genuine trend reversals.

What makes this golden cross especially compelling is the backdrop in which it has occurred. The ratio isn’t simply brushing against the moving averages; it has surged decisively above both. At the same time, the 26-week SMA is rising at a sharp angle while the 104-week SMA has begun to curl upward. This alignment tells us the market is not dealing with a tentative bounce, but rather with a move built on solid momentum.

Why This Ratio Matters for Investors

To fully appreciate the importance of the SILJ/Silver ratio, it’s essential to first understand the unique leverage dynamic that mining equities have compared to the metal itself.

Silver bullion functions as the anchor of the sector. It tends to move steadily, reflecting the broad strokes of macroeconomic conditions. Silver miners, by contrast, are the leveraged expressions of the metal. They behave almost like call options on silver: when silver prices rise, miners’ revenues expand while many of their costs remain relatively fixed. That margin expansion translates into outsized earnings growth, which ultimately fuels outsized share price performance.

Of course, the leverage works in both directions. When silver prices fall, miners’ profits collapse even more dramatically. That’s why the last nine years of sluggish silver performance have been so punishing for mining equities. Investors preferred the relative safety of physical silver, while miners were left to endure rising costs, scarce financing, and near-total neglect.

This leverage dynamic is exactly why the SILJ/Silver ratio is so critical for investors to monitor. It acts as a compass, showing where capital is flowing within the precious metals space. When the ratio is rising, it signals that investors are embracing risk and allocating toward miners. When it’s falling, it reflects retreat into the defensive posture of bullion.

The recent breakout, occurring after nearly a decade of underperformance, makes this signal especially meaningful. It tells us the pendulum has swung decisively back toward risk-taking in the sector. For traders and portfolio managers alike, that makes the SILJ/Silver ratio not just an interesting chart, but one of the most important intermarket gauges to watch.

Why This Time Looks Different

Skeptics will be quick to argue that we’ve seen this movie before—that silver miners have flashed strength in the past only to disappoint later. That’s a fair point. But the weight of evidence this time tells a different story, and there are several reasons why the current breakout carries more significance than the false starts of the past.

To begin with, the technical structure has changed in a way that cannot be dismissed. The SILJ/Silver ratio hasn’t merely staged another bounce; it has broken decisively above a 9-year downtrend that capped every rally attempt since 2016. This breakout was reinforced by a golden cross between the 26- and 104-week SMAs, a rare event that typically marks the transition from a bear cycle into a new bull phase. Put together, these signals point to a structural shift, not just another temporary rally.

The strength of this breakout is underscored by what is happening in SILJ itself. In early September 2025, the ETF not only broke through a 9-year resistance but also surged to a new all-time high, continuing higher in the weeks since. This dual confirmation—miners setting fresh absolute highs while also outperforming silver—marks a decisive change in character. In previous rallies, SILJ consistently stalled before reaching new peaks, but this time the ceiling has been cleared with conviction.

The macro backdrop further reinforces the case. Inflationary pressures, geopolitical instability, and declining real yields are all driving a sustained bid for hard assets. Unlike the “fake reflations” of the past, which lost steam as central banks tightened policy, today’s environment favors durable flows into commodities. And silver, with its dual role as both a monetary and industrial metal, stands to benefit from this unique alignment.

At the same time, a broader rotation of capital is underway. For much of the past decade, money flowed overwhelmingly into technology and growth stocks, leaving silver miners neglected and undervalued. That tide is now turning. With miners still trading at historically depressed valuations relative to silver, even modest inflows can spark outsized moves. The recent surge in SILJ is one of the clearest signs that this reallocation of capital is already in progress.

Taken together, these technical, fundamental, and capital-flow dynamics make the current breakout far more compelling than anything we’ve seen in years. This isn’t simply another rally running into overhead resistance. It represents a true regime change, where miners are finally stepping into leadership, supported by both market structure and macro tailwinds.

Learning from 2016 and 2020

History offers a useful guide. The last two times miners staged major outperformance—in 2016 and again in 2020—the SILJ/Silver ratio signaled the move early. In both cases, miners went on to deliver triple-digit percentage gains, while silver itself advanced at a far more modest pace.

What sets the current breakout apart is its duration. Unlike those earlier rallies, which emerged from short corrective phases, today’s move follows nearly a decade in which miners were abandoned, diluted, and largely written off. That kind of long-term neglect doesn’t just suppress prices; it creates the conditions for powerful mean reversion once the cycle finally turns.

This context also makes the breakout less likely to be a false start. Short-term corrections often produce head fakes, where momentum briefly lifts miners before rolling over again. But breaking a 9-year downtrend and confirming it with a golden cross on the weekly chart is a different story altogether: it signals structural change, not temporary noise.

Zooming out, the implications are clear. Junior miners have historically outperformed during the later stages of precious metals bull markets, when speculative flows intensify and investors seek leveraged plays. If the ratio’s current uptrend holds, it suggests that silver’s broader cycle is maturing into a more aggressive phase.

Equally important, this time the equities are confirming silver’s strength. In past rallies, skeptics often cited miner underperformance as evidence that silver’s advances were unsustainable. Now, with the ratio turning higher, that divergence has resolved, removing a key bearish argument.

For portfolio managers, this shift creates a tactical opportunity: overweight silver miners relative to bullion. For traders, it offers a clear roadmap: as long as the ratio holds above its breakout zone, dips should be viewed not as reasons to sell, but as opportunities to add exposure.

Key Levels to Watch

At roughly 0.50, the ratio currently rests at a key psychological round number, marking its highest weekly close since mid-2022. That milestone signals real progress, but it also sets the stage for the next critical challenge.

The immediate hurdle lies in the 0.59–0.63 resistance zone, a range that previously acted as strong support during 2017–2018 before later flipping into overhead resistance. Clearing this level decisively would provide strong confirmation that miners are not just starting to outperform silver, but are capable of sustaining leadership into the next phase of the bull cycle.

Equally important is the need to defend the 0.42–0.44 breakout zone, which now functions as critical support. If the ratio pulls back, holding this level would reinforce the legitimacy of the breakout and keep the bullish case intact. A decisive failure there, however, would raise the risk of a false move. For now, though, momentum clearly favors the bulls, keeping the bias tilted toward further miner outperformance.

The Bottom Line

The 9-year winter for silver miners appears to be over. The decisive breakout of the SILJ/Silver ratio—reinforced by a golden cross, new all-time highs in SILJ itself, and a supportive macro backdrop—marks a turning point that is difficult to dismiss.

History gives us a strong precedent for what may come next. In previous cycles, when this ratio has turned, miners didn’t just keep pace with silver; they left it far behind, delivering triple-digit gains while the metal itself advanced far more modestly. What makes the current setup even more compelling is the context: this breakout follows nearly a decade of capitulation, arriving at the same time as strengthening fundamentals and a broad rotation of capital back into hard assets. Alignments like this are rare.

For investors, the message is clear. The long winter has ended, and the thaw has begun. The real question now is no longer whether miners can outperform silver, but how far this new cycle of leadership can ultimately run.