By Bl Mumbai Bureau

Copyright thehindubusinessline

After a hiatus of more than two decades, the RBI may consider giving licenses for setting up new Urban Cooperative Banks (UCBs).

“Since 2004, issuance of fresh licenses for UCBs has been paused following the weak financial health of the UCB Sector.

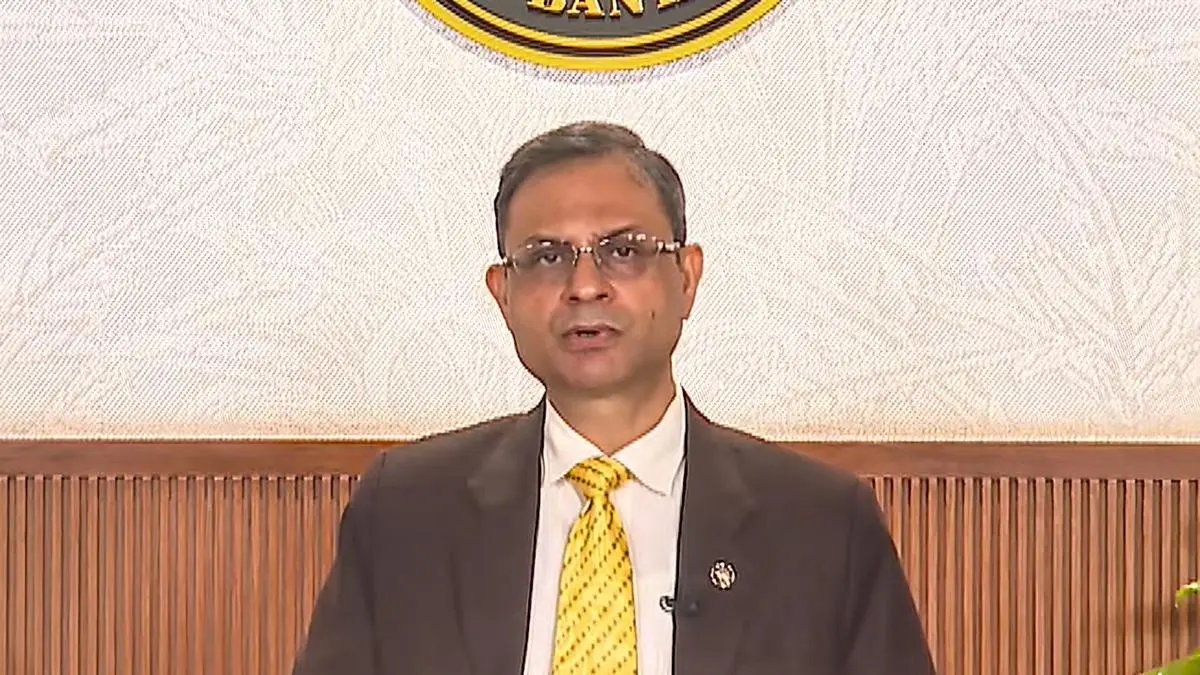

“Considering that more than two decades have passed since then and the positive developments in the sector, a discussion paper on licensing of new UCBs will be issued shortly,” said Governor Sanjay Malhotra.

As of the end of March 2024, there were 1,472 UCBs in the country. The RBI, in its report on the trend and progress of banking in India, noted that the number of UCBs surged in the 1990s, driven by a liberal licensing policy. Over the years, nearly one-third of the newly licensed banks have become financially unsound.

“Starting 2004-05, the Reserve Bank initiated a process of consolidation, including amalgamation of unviable UCBs with their viable counterparts, closure of non-viable entities and suspension of issuance of new licences. As a result, the number of UCBs declined steadily over the last two decades from 1,926 to 1,472,” per the report.

The report noted that deposit growth of all UCBs exhibited a marginal improvement to 4.1 per cent during 2023-24, remaining well below 13.4 per cent growth in SCBs (scheduled commercial banks). Credit growth of UCBs was steady at 5.0 per cent in 2023-24, less than a third of the expansion of 16.0 per cent recorded by SCBs.

Prabhat Chaturvedi, CEO, National Urban Cooperative Finance & Development Corporation (NUCFDC), said: “We welcome the RBI’s announcement to publish a discussion paper on licensing new Urban Cooperative Banks. This forward-looking initiative reflects the sector’s positive momentum and presents an opportunity to strengthen governance, drive responsible growth, and expand the cooperative banking model to underserved communities.

“As the Umbrella Organisation of these UCBs, NUCFDC views this as a significant step toward deepening financial inclusion, improving credit flow and reinforcing the stability and credibility of UCBs in India’s financial ecosystem.”

Published on October 1, 2025