By Sai Keerthi

Copyright yourstory

UNLEASH Capital Partners on Tuesday closed its maiden fund, with a target corpus of Rs 300 crore to fund Indian startups working on tech-based financial inclusion.

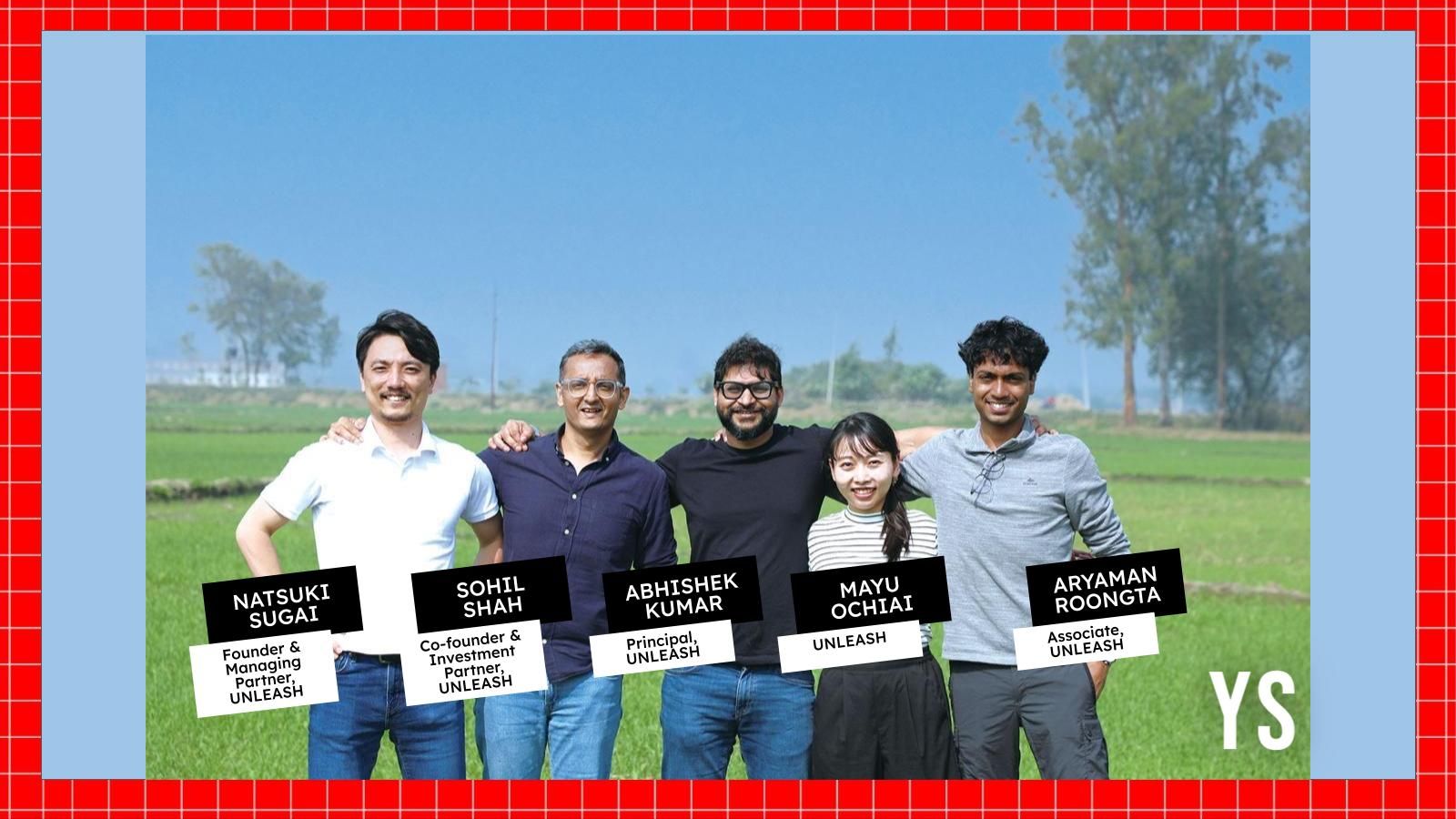

The firm, co-general partnered by Natsuki Sugai and Gojo & Company, Inc., aims to make investments in 12 to 15 early-stage startups, with individual ticket sizes between Rs 5 crore and Rs 18 crore.

According to the VC, its inaugural fund attracted about 35 Japanese Limited Partners (LPs) and was oversubscribed against the initial target. The firm also has the flexibility to lead investments or co-invest alongside like-minded investors.

“We are incredibly grateful for the trust placed in us by our diverse Japanese LPs. This fund represents a powerful bridge, channelling Japanese capital and expertise into India’s most promising fintech and financial service innovators. By empowering these early-stage companies, we believe we can create scalable solutions that lead to profound and lasting financial equity for credible startups that will pave the way for disruption in India,” said Natsuki Sugai, Founder and Managing Partner at UNLEASH Capital Partners.

According to the firm, beyond providing capital, the fund also offers deep industry knowledge, with a specialised focus on financial services and fintech sectors, as well as impact-minded investment and global connectivity.

Portfolio companies will be able to tap into UNLEASH’s pool of Japan-based investors for equity and debt capital, as well as business collaborations and potential M&A opportunities.

The VC firm’s portfolio includes Bengaluru-based LetzRyd, which offers fleet management and leasing solutions; Hyderabad-based NBFC CredRight, and Mumbai-based Ayekart, which offers a full-stack agritech platform, among others.

(Edited by Suman Singh)