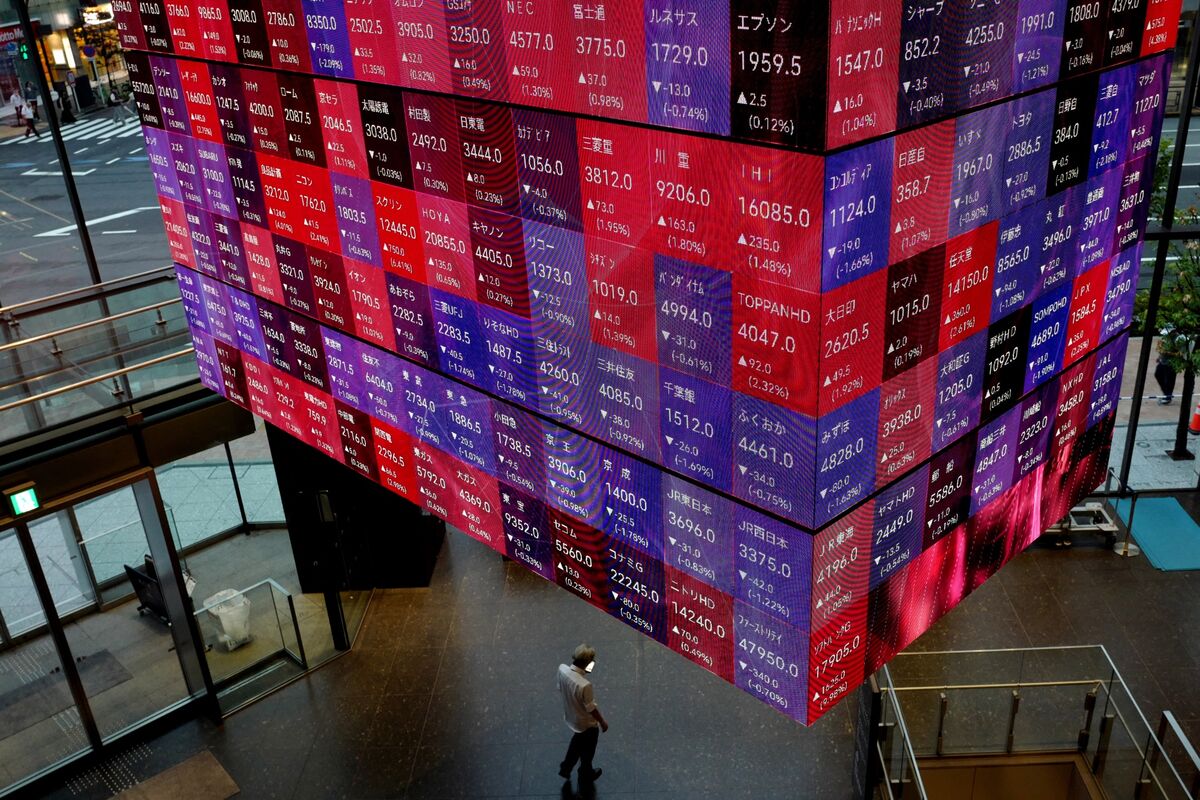

Market makers are the grease that keeps financial wheels turning. In crypto, they’ve often been the grit. For more than a decade, firms paid to provide liquidity in digital tokens have faced accusations of inflating volumes, propping up prices and engineering pump-and-dump schemes. Token projects, desperate for liquidity, signed opaque deals with trading firms whose incentives weren’t always aligned with their own. The result has been a business that looks less like financial plumbing and more like a Wild West shoot-out.

Now change is afoot. As more traditional investors enter the sector, expectations are shifting. Demands for transparency, compliance and proof of fair play are on the up. At the same time, on-chain infrastructure is evolving in ways that make trading behavior auditable in real time. Crypto’s market makers, long shielded by opacity, are about to be dragged blinking into the light.

A house of ill repute

The abuses are hardly theoretical. A recent report by Chainalysis estimated that wash trading accounted for $2.6bn of crypto-exchange volumes last year. Around 3.5% of all tokens launched last year displayed the tell-tale signs of pump-and-dump schemes. The share looks modest until one recalls that more than 2m tokens were launched in the same period. Few ever found an active market. Many seemed designed only to exploit early enthusiasm before vanishing into obscurity.

Such practices would be illegal in conventional finance. In crypto they have been tolerated, if not condoned. Yet institutional investors – accustomed to regulated exchanges and accountable market makers – are unlikely to stomach them. If the sector wants fresh capital, it will have to mend its ways.

The mechanics of liquidity

Market makers, at least in principle, serve a noble function. By standing ready to buy and sell, they tighten bid-ask spreads and ensure that investors can transact quickly without moving prices wildly. They earn their crust from the spread itself. A narrow one suggests efficiency; a wide one can be lucrative for the market maker but costly for everyone else.

In practice, crypto’s arrangements have often been murky. Contracts between token projects and market makers can be highly bespoke, with incentives to inflate metrics rather than nurture healthy trading. Such opacity has fueled distrust. A survey this year by LO:TECH, a crypto-market-making service, found that more than half of respondents harbored little faith in market makers. Some 70% even wanted rogue operators to face trial.

Standard deviation

LO:TECH’s report notes that while crypto has transformed in the past decade, two things have not: the essential role of market makers, and the persistent confusion over what good ones should do. The firm proposes importing a dose of tradition. Legally defined documentation standards, modelled on those in mainstream finance, could clarify rights and obligations, cut down wrangling and reduce risk.

Such standards would need to be adapted for Web3, using template agreements that are transparent and enforceable on-chain. The aim is simple: to replace a culture of handshakes and half-truths with one of contracts and clarity.

On-chain remedies

Technology, too, may provide discipline. Automated market makers (AMMs) – algorithms that set prices according to liquidity pools – have already become a cornerstone of decentralised finance. But most tokens still rely on centralised order books and off-chain market makers. A new generation of on-chain limit-order books promises to marry the structure of traditional trading with the transparency of blockchain.

These systems are “composable”, meaning strategies and inventory management can be automated and audited. Protocols may also take more direct control over liquidity. Vault-based models, for instance, allow assets to be pooled for market-making purposes under clear rules, with community participation and performance-based yields. In theory, this reduces opportunities for abuse and aligns incentives between projects, liquidity providers and traders.

The take away

Some crypto market makers have thrived by exploiting opacity. In the future they’ll be judged on infrastructure. Success will depend less on who can deliver the tightest spreads, and more on who can provide transparent systems that integrate seamlessly with on-chain protocols. Standards, composability and incentive alignment will become the watchwords.

Sceptics will argue that bad actors always adapt, and that no amount of code can substitute for trust. Yet if crypto is to keep bringing serious investors onboard, it needs to show that its liquidity providers are more than hired guns. Done right, the reforms could turn market makers from necessary evils into respected partners – proof that even in crypto, sunlight can be the best disinfectant.