By Akanksha Arora

Copyright timesnownews

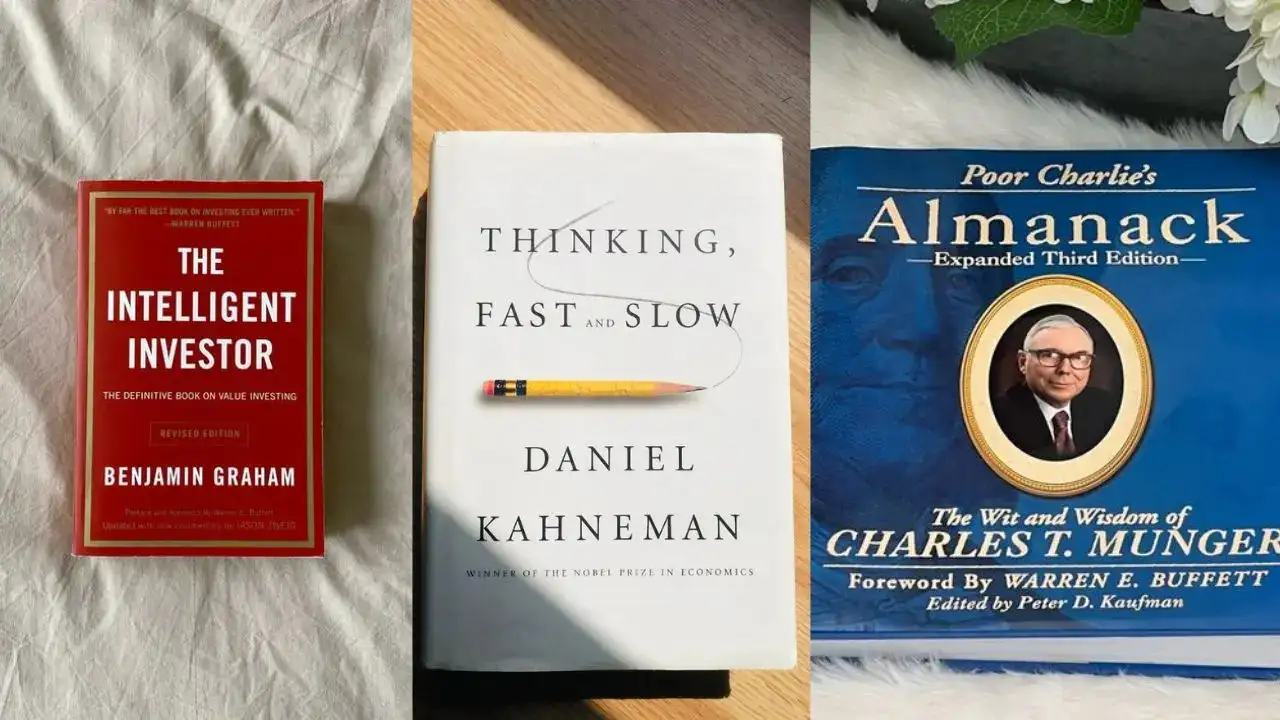

Warren Buffett, often called the “Oracle of Omaha,” is not just admired for the empire that he has created but also for his disciplined and patient approach to investing. Buffett has time and again credited much of his success to reading voraciously and learning from the timeless wisdom of great investors, economists and business leaders. If you are someone who wants to be among the top 1% of investors, learning from Buffett’s reading list is an excellent place to start. These six books will teach you value investing, behavioral finance, risk management, and business acumen that can transform the way you think about money and markets. The Intelligent Investor by Benjamin GrahamNo book has had a greater influence on Warren Buffett than this one. Buffett famously calls it “the best book on investing ever written.” Graham, who is regarded as the father of value investing, highlights principles that emphasize buying undervalued stocks, maintaining a margin of safety, and practicing discipline over speculation. The book talks about one timeless lesson: Markets are driven by short-term emotions but reward rational, patient investors in the long run. Security Analysis by Benjamin Graham and David DoddBefore The Intelligent Investor, Graham and his colleague David Dodd co-authored Security Analysis. This happens to be another cornerstone of Buffett’s education. It is considered the Bible of value investing. This book delves deeper into the technical aspects of analysing securities, evaluating intrinsic value and understanding financial statements. Buffett has often said that reading this book at Columbia University changed the trajectory of his career. If you want to understand valuation the way Buffett does, this book is indispensable. Common Stocks and Uncommon Profits by Philip FisherLike Graham taught Buffett the importance of numbers, Philip Fisher taught him the importance of business quality and management. In Common Stocks and Uncommon Profits, Fisher argues that successful investing is not just about balance sheets, it is about evaluating a company’s long-term potential. In the book, Fisher introduces the concept of “scuttlebutt.” For the unversed, this refers to the concept of doing deep research about a company by speaking to employees, customers, suppliers, and competitors. His famous “15 Points” checklist helps investors identify companies with strong management, innovative practices and sustainable growth. Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. MungerCharlie Munger, who is Buffett’s long-time business partner at Berkshire Hathaway, integral to Buffett’s success as Graham and Fisher. Poor Charlie’s Almanack compiles Munger’s speeches, essays and insights on investing, decision-making and life. Munger advocates for a “latticework of mental models,” as he encourages investors to draw wisdom from multiple disciplines – economics, psychology, history and more. The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett, edited by Lawrence CunninghamIf you want to hear directly from the master himself, The Essays of Warren Buffett is extremely essential. Edited by Lawrence Cunningham, this collection organizes Buffett’s annual letters to Berkshire Hathaway shareholders. It is divided into themes like corporate governance, investing principles, mergers and acquisitions and business philosophy. Buffett focusses on the importance of integrity, long-term thinking and aligning management’s interests with shareholders. Thinking, Fast and Slow by Daniel KahnemanWritten by Nobel laureate Daniel Kahneman, this groundbreaking bok explores the two different systems that drive the way we think: the fast, intuitive, emotional system and the slow, deliberate, logical one. The author uses some of the real-life examples and cognitive experiments to justify the decisions that we make. It is a must-read for anyone seeking to understand the mechanics of human judgment, decision-making, and thought processes.