Copyright The Street

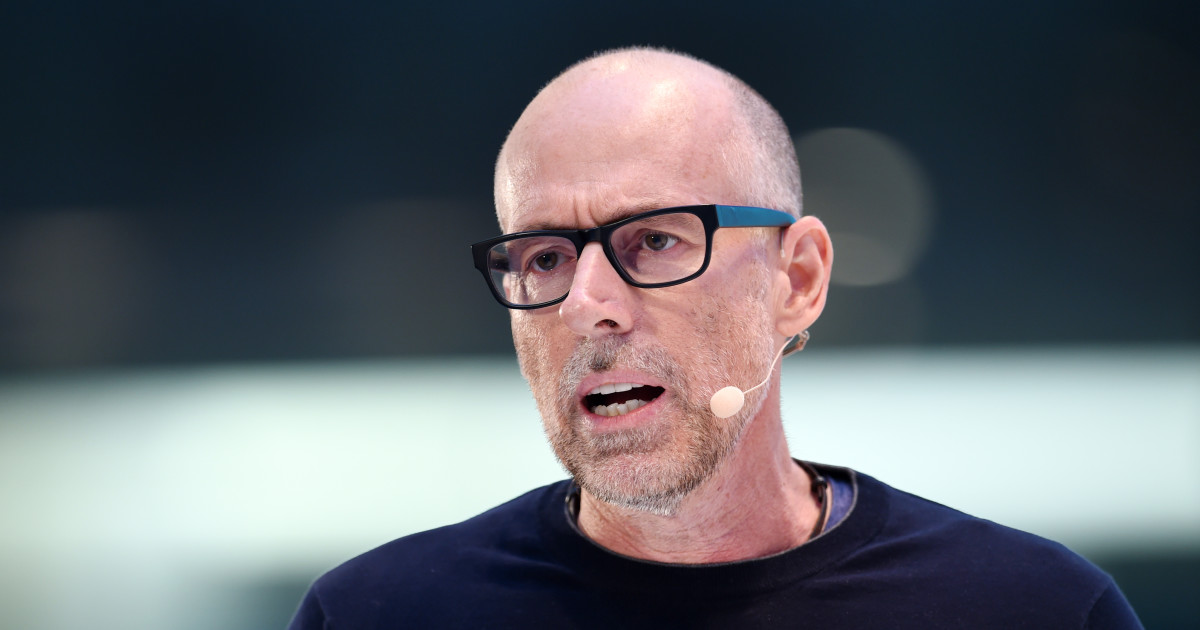

Quick facts: Scott Galloway is a prolific personal finance speaker who hosts two popular podcasts and serves as a professor at NYU. He often dispenses financial advice through his YouTube channel. Here, we’ve collected 15 of his most impactful personal finance insights. Scott Galloway has made a name for himself by making accurate predictions about where industries and companies are headed, especially when it comes to technology. As an entrepreneur, NYU professor, and podcaster, he also dispenses some wisdom on how to build wealth. On his YouTube channel, The Prof G Pod — Scott Galloway, he often talks about how he grew up without wealth, having been raised by his mother, who supported them with a secretary’s salary. Galloway often describes his struggles in becoming wealthy and how things changed for him once he became rich. He’s founded multiple companies, some of which have failed, and he didn’t really strike it rich until after the 2007–2008 financial crisis. As of 2025, his net worth is estimated to be around $100 million. Galloway has said that he’s hit his “number” when it comes to attaining wealth and that he doesn’t want to pursue becoming a billionaire. To Galloway, having enough money means not being stressed due to the lack of it, and he has certainly accumulated enough wealth to live the way he wants, spending freely on both personal pursuits and philanthropic ones. Scott Galloway’s advice on building personal wealth In his YouTube videos, Galloway describes how his mother was able to raise him on her meager salary as a secretary and how he attended UCLA for almost free. Part of his goal on his path to higher income was to make enough money to care for his mother. Starting out after graduation isn’t always easy, but Galloway dispenses some invaluable advice on how to earn money and what areas to focus on. He suggests that young people in the early stages of their careers live in a city where they can meet and compete against the best in their field. Another way is to focus on industries and themes that are poised for growth. For him, this meant starting e-commerce-related companies and investing in Amazon. The dispersion of healthcare, work, education, and fintech is causing tidal waves of change, he said. As for investment, it pays to diversify your assets and not put all of your financial eggs into one basket, so to speak. 15 of Scott Galloway’s best quotes on personal finance These 15 quotes encapsulate some of Galloway’s most poignant insights about income, spending, saving, investing, money, debt management, and jobs. Income “So what is the algebra of wealth? From my experience, it comes down to this formula. Focus, plus the product of stoicism, time, and diversification.” Focus “Focusing on finding something you’re great at, something you can do better than most other people, something that people will pay you for.” “The second thing you should focus on [is] investing in the right relationships. While this applies to business relationships, the single most important economic decision you will ever make is your partner. Research shows that married individuals experience per person net worth increases of 77% greater than their single counterparts. However, marriage is betting half your future net worth that you’ll be partners forever, meaning divorce is costly.” Stoicism “Living below your means is the clearest blue flame path to financial freedom. Because it isn’t your salary that makes you rich, it’s your spending habits. Any fool can make money. It’s more difficult to hold on to it.” Time “In the long term, time is your ally. In the short term, it’s your enemy. The amount of time we have is completely out of our control. Do not squander it. Time is the one thing you should not be generous with. Invest early and make it a habit. The math on compound interest doesn’t lie. Starting early with a little can beat starting a little later with a lot.” Diversification “Diversification is your Kevlar and ensures that no one bad decision is a fatal blow. Bulletproof vests don’t stop you from getting shot or stop the pain. They just stop the bullets from killing you.” Source: The Algebra of Wealth Spending “I was really stressed out about money and not being — it’s one thing, like, to fail yourself. I’m talented. I can always make enough money to take care of myself. And I’m like, God, I don’t have as much money as I thought I was going to have. So getting financial security or economic security for me was just an absence of stress.” “I do amazing things with money and I think I’m really good at it. I hit my number and I decided to get off the money hamster wheel. I hit my number eight years ago.” Source: Scott Galloway on Reaching His Number and Refusing To Chase Billions Saving and investing “The first thing you do when you take any job is you want to find out what type of tax deferred or tax advantaged investments and matching programs there are and immediately max them out.” “You save $100 a month from the age of 22, you’re going to be a millionaire by the time you’re 65. 100 bucks. Start now.” Source: Scott Galloway on the Future of 401(k)s “So you get to a point where you have enough money in the bank, where assuming a 6% return that covers your burn. So, what people constantly focus on is how much money they make. Well, no, it’s not even that. It’s how much money you save and have invested that’s spinning off passive income. And what people really don’t focus on is how much they spend.” Source: Scott Galloway on Being Addicted To Money, Beating Imposter Syndrome & More More on money Dave Ramsey’s net worth: The personal finance pundit’s wealth in 2025 Barbara Corcoran’s 4 best personal finance insights Suze Orman’s 5 best pieces of financial advice Money and debt management “I think men should take economic responsibility for their household or assume that they’re going to be the economic driver of their household. And sometimes, quite frankly, that means getting out of the way and being more supportive of your partner if he or she happens to be better at this whole money thing than you.” Source: Scott Galloway on Being Addicted To Money, Beating Imposter Syndrome & More Jobs “If I were just an economic animal coming out of school, I would try and probably try and position myself somewhere between the intersection between AI and healthcare.” Source: Raising Kids in a Divided America, The Silver Tsunami, and Early Career Advice “So the key when you’re hunting for a job in general is to be as social as possible. Go out meet as many people as possible. Have fun. Contact people. Make as many contacts as possible and let people know that you’re looking. And it’s in some the most popular kids in high school aren’t the best looking, the smartest, or the best athletes. They’re the ones that like the most other people. So to a certain extent, networking and looking for a job is a popularity contest. And how do you become most popular and put yourself in a room of opportunities even when you’re not physically in it? You like as many other people as possible.” “You’re as social as possible. So one, a series of small disciplined acts every day. Two, don’t be afraid and let your ego get in the way of calling out or calling people and reaching out and asking you for help. And three, be as social as possible and let people know that you’re looking for a job.”