Copyright The Street

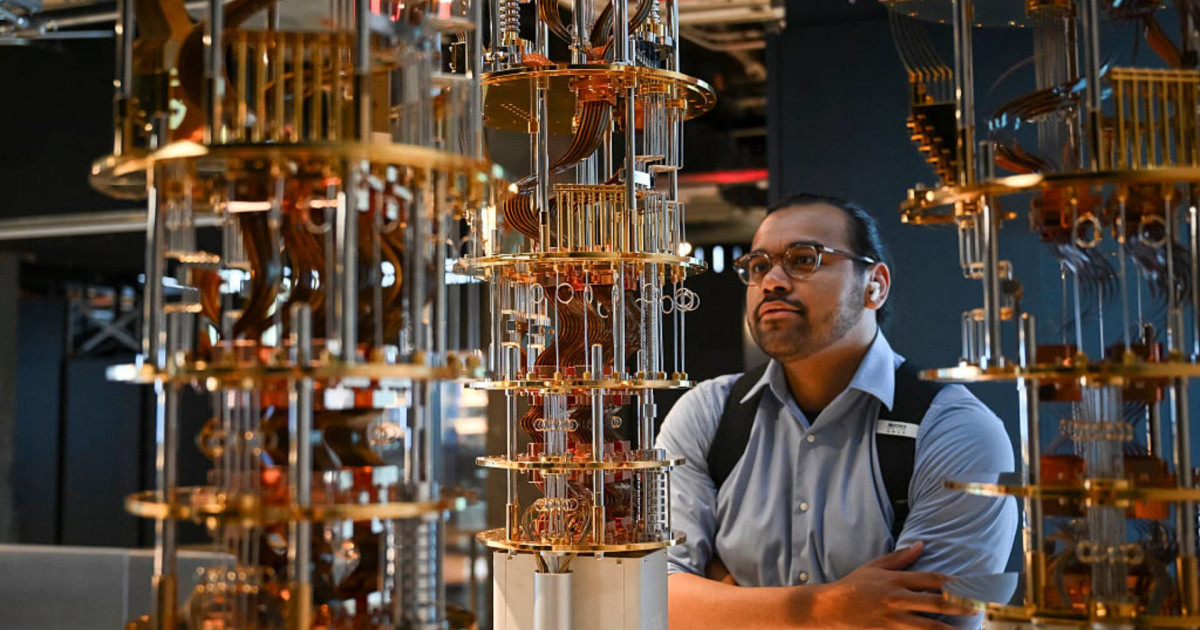

Key Points IBM cracks a quantum puzzle that could finally make the tech feel real. Estimates show that the quantum market is projected to grow from $1.3 billion (2024) to $5.3 billion by (2029). Improved quantum tools could revolutionize drug discovery, finance, and energy grid optimization. Quantum Computing felt like Star Trek for the most part, but today it’s edging toward spreadsheets. Earlier this year, Google’s Willow chip showed error rates are efficiently bending in the right direction. Still, now International Business Machines Corporation (IBM), one of the bellwethers in the space, has just revealed a new algorithm that promises a cleaner math route around famously nasty computations. Though it may seem like mumbo jumbo to most, the math behind IBM’s latest quantum twist can effectively reshape computers as we know them. But why should we non-physicists care? Well, quicker quantum tools can potentially shave years off drug discovery, optimize power grids, and turbocharge logistics and finance models in the process. For investors, the quantum computing trade is well and truly on, which defies the bubble talk making the rounds. In other words, it’s a lot less sci-fi and more ROI, with IBM and Google racing to effectively turn whiteboard breakthroughs into useful machines. What IBM’s new algorithm actually does At the core of it, IBM’s new algorithm is tackling something that feels abstract but is evident everywhere: patterns within patterns. From purely a math perspective, those are called Kronecker coefficients, numbers showing how two sets of patterns fit together when they’re combined. These may seem insignificant, but they’re huge in terms of physics and computer science, modeling everything from molecular interactions to data organization. The bottleneck, though, is that they’re brutally hard for normal computers to calculate. More Tech Stocks: Senior analyst lifts Palantir stock price target with a catch Nvidia just scored a massive AI win, but CEO Huang has regrets Apple’s iPhone 17 story just took an unexpected turn Analysts revamp Salesforce stock forecast after key meeting IBM’s researchers felt that quantum systems, which juggle overlapping issues, might be better suited for this. Hence, they’ve built a framework called QXC, or quantum approximate counting, to estimate how valid solutions exist. The technique, called phase estimation, is essentially listening for hidden “beats” within a quantum system, showing the algorithm could find answers far more swiftly than classical methods. So far, it’s theoretical, but it pushes quantum computing closer to real-world traction. Quantum market growth estimates MarketsandMarkets: From $1.3 billion (2024) to $5.3 billion by 2029, a superb 33% CAGR with pilots turning into paid workloads. McKinsey (2025 Monitor): Quantum companies booked $650 million to $750 million in 2024 and could surge past $1 billion to $1.1 billion in 2025 (real sales, still in the early innings). BCG: The provider market is forecasted to reach $1 billion to $2 billion by 2030, but its broader economic value may exceed $850 billion by 2040 if adoption reaches key use cases. Why the classical challenge has been so tough Classical computers struggle with Kronecker coefficients, as the math can potentially scale out of control. Every new variable makes things even more complex, creating what’s referred to as a “combinatorial explosion” that even supercomputers find tough to handle. Technology AMD CEO flips the script on AI dominance New AMD wins raise quiet doubts about Nvidia’s edge. Moz Farooque AMD IBM’s new approach, though, effectively flips that script. By using quantum “phase estimation,” its algorithm is able to sample overlapping outcomes simultaneously, much like scanning multiple radio stations at once. The end result is a meaningfully quicker solution for problems that stump classical math. Where quantum advancements could actually matter: Drug discovery: Quantum models could potentially simulate how proteins fold and interact in seconds. That’s the kind of work that cuts design time for a new cancer drug from years to months. Finance: A quantum risk model can effectively test thousands of market scenarios, where banks could fine-tune portfolios in real time instead of overnight. Energy grids: Quantum optimization could balance solar, wind, and battery loads across vast grids in minutes, reducing blackouts and wasted power. Why that matters to investors As algorithms become leaner, hardware requirements tend to drop in tandem, which makes proof-of-concepts a lot more affordable. That adds more fuel for pilot projects to emerge in pharma, materials, and finance. Publicly U.S.-listed quantum computing stocks IBM (IBM): The superconducting-qubit leader is now pushing for an algorithmic edge that reduces cost on hard math. Alphabet/Google (GOOGL): Its quantum AI division just hit breakthrough error-correction milestones with Willow. Microsoft (MSFT): It’s a hedged bet on partners’ hardware while pursuing topological qubits and cloud tooling. Amazon (AMZN): Braket rents time on multiple quantum processing units (superconducting, trapped-ion, neutral-atom). IonQ (IONQ): Its trapped-ion (laser-controlled qubits) are a pure play with growing sales and cloud integrations. Rigetti (RGTI): Superconducting chiplets support a 36-qubit system that just went live, targeting 100+ by year-end by chasing fidelity/coherence gains. D-Wave (QBTS): Annealing systems (energy-minimizing problem solver) aimed at optimization, along with expanding deployments (Advantage2). Honeywell (HON): Majority owner of Quantinuum (private) has fresh funding, sparking IPO chatter. Technology Veteran fund manager sees quiet fuel for next AI rally Something subtle in Big Tech’s plans has Wall Street listening. Moz Farooque GOOGL META MSFT About the authors Moz (Muslim) Farooque is a financial journalist, U.S. stock and crypto analyst, and founding editor at Undervalued Deep Insights.He specializes in deep dives on AI & emerging tech, electric-vehicle disruptors, big-tech giants, blockchain & crypto markets, and entertainment & media stocks. Celine is an experienced writer and editor covering news, features, academic/research, and legal topics for over 20 years. At TheStreet.com, Celine is a senior editor with experience across retail, stocks, investing, personal finance, technology, the economy, and travel.