Copyright news

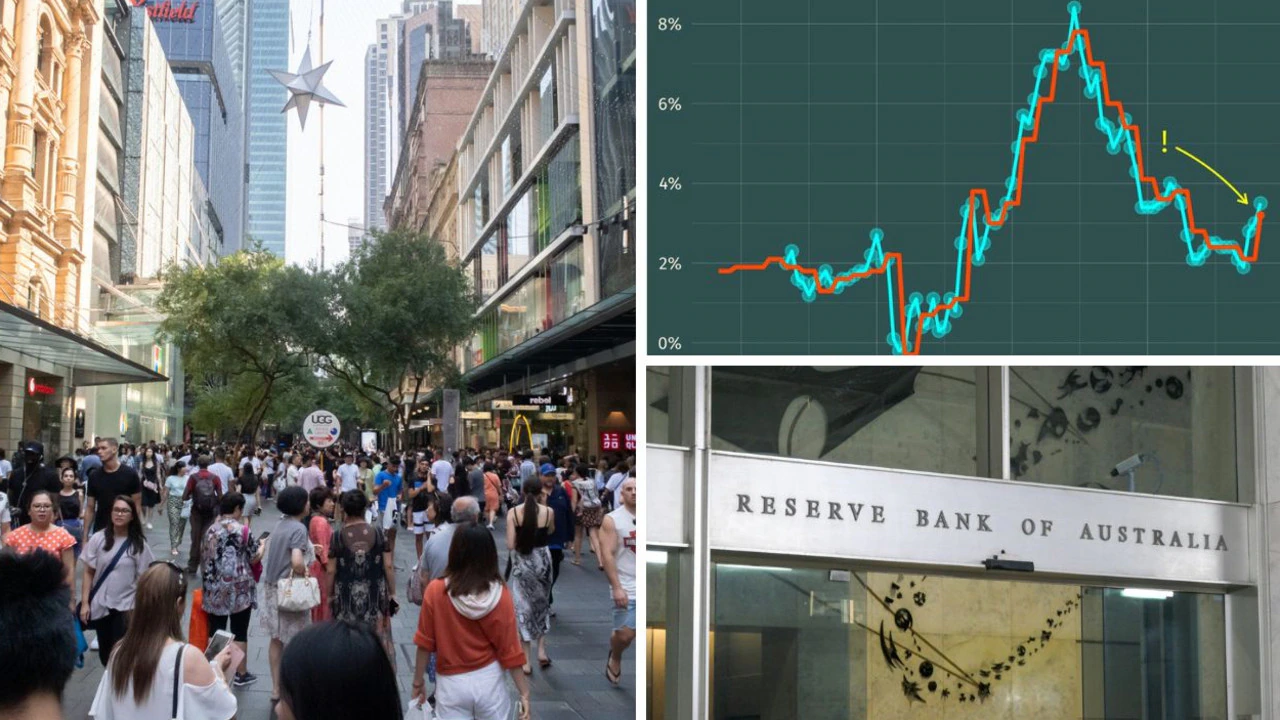

Deals of the Week 12:40AMThursday, October 30th, 2025 In the know quiz Set your local weather Breaking News Courts & Law Courts & Law Courts & Law Courts & Law South Australia Western Australia Northern Territory Breaking News North America US Politics South America Middle East UK Politics Health Problems Mental Health Inspiration Weight Loss School Life Restaurants & Bars Food Warnings Relationships The Sealed Section Family & Friends Fashion Shows Fashion Trends Face & Body Cosmetic Surgery True Stories Lifestyle Videos Travel Ideas Short Breaks Food & Drinks Destinations North America New Zealand Middle East Central America South America Travel Advice Tips & Tricks Accommodation Australian Holidays Northern Territory South Australia Western Australia Travel Videos Entertainment Celebrity Life Hook Ups & Break ups Celebrity Photos Celebrity Kids Celebrity Deaths Celebrity Style What To Watch Morning Shows Current Affairs Upcoming Movies Movies Reviews Music Festivals Books & Magazines Golden Globes Entertainment Videos Social Media Mobile Phones Home Entertainment Archaeology Environment Climate Change Sustainability Natural Wonders Motoring News On the Road Technology Videos Cost of Living How to Save Salary Secrets Personal Finance Superannuation Australian Culture Power & Influence Inside Parliament Gig Economy Breaking News Manufacturing Other Industries Australian Economy World Economy Interest Rates Federal Budget Australian Markets World Markets Australian Dollar Cryptocurrency Real Estate Sydney & NSW Melbourne & VIC Adelaide & SA Cricket Live Scores V8 Supercars Sports Life American Sports Paralympics Horse Racing Expert Opinion More Sports Sport Videos Sales & Deals Home & Appliances Health & Wellbeing Australian Economy ‘We’re stuffed now’: Why everything just changed for Australians Australians have been left reeling after a shock inflation spike that might truly change everything. This is what you need to know. Jason Murphy @jasemurphy October 30, 2025 - 11:35AM 199 Comments Ascolta questo articolo Copied URL to clipboard Interest rate cut unlikely after inflation rises The RBA's interest rate-cutting cycle could be over after inflation rose more than expected in the September quarter. Oh no. We’re stuffed now. Australian inflation has shot up in an astonishing 3-month turnaround that throws the economy and the RBA into complete disarray. For the last few quarters inflation has been looking tamer and tamer. A sense of relaxation was slowly creeping back for Australian households. Maybe, just maybe prices had stopped rising so awfully fast? Maybe we could enjoy some stability? Copied URL to clipboard 2005 receipt you'll want to see A mum has shared a side by... The RBA forecast moderate inflation and it began to cautiously trim interest rates. But suddenly inflation has turned on us again, vicious and aggressive. The data shows it clearly. After falling to as low as 2.1 per cent in the April-May-June quarter, consumer price inflation is back up to 3.2 per cent in the July-August-September quarter. And higher still in monthly terms in September – a sickening result of 3.5 per cent. Australia has been left reeling from this sudden inflation spike. Picture: ABS MORE: Australia’s most undervalued and overvalued suburbs Remember that the RBA’s target for inflation is between 2 and 3 per cent. It doesn’t have to be in that range literally all the time, just on average over the medium term. But yikes, look how steep the recent rise is. This result is going to make the RBA feel sheepish about the rate cuts they have been doling out, and revise their inflation forecasts up. Rate cuts make life easier for households by reducing their mortgage rates (assuming banks pass the rate cut on). This comes with a risk of higher inflation. Why? Because companies can raise prices more easily if people are happily spending more. And that’s what inflation is: price rises. Higher inflation means the RBA will deliver fewer rate cuts. Inflation of 3.2 per cent means the chance of a rate cut this summer just melted away like a Calippo dropped on hot asphalt. The RBA has been thrown into disarray. Picture: iStock MORE: Australia’s secret growth suburbs revealed We can quantify that icy pole metaphor quite precisely. The chance of a rate cut at the next meeting was 62 per cent a week ago - more likely than not. Now the chance is just 9 per cent, i.e. not going to happen. There’s now even a 2 per cent chance of a rate hike, if the RBA decides to get militant on inflation (it won’t). Why is this happening? So where has this surprise inflation come from? The simple answer is: electricity bills. The price of power went up 9 per cent in the last 3 months alone, for a total rise of 23.6 per cent over the last 12 months. It’s rare to see such a massive lift, and the reason is also an unusual one. It’s not just that electricity companies raised prices – it’s that all the rebates and discounts being offered by governments ran out. That said, electricity companies did lift prices at the same time. Bills went up 4.8 per cent in the quarter even excluding the loss of rebates. So it’s a double whammy, just on electricity. Electricity bills are only going up. Picture: iStock And actually the issue is broader than just power. Property rates went up a lot and so did domestic travel. It wasn’t the usual suspects, interestingly. Rents and insurance actually rose more slowly in the latest quarter than they had been rising recently. Christmas is ruined The RBA almost certainly won’t be handing out a rate cut before Christmas. (Commonwealth bank say they won’t be handing out another rate cut at all this cycle, i.e. the next move will be a rate hike.) That will be tough news for retailers and hospitality businesses who need consumers to spend up big. Commonwealth Bank is expecting shoppers to turn despondent. “Consumer sentiment remains fragile and with expectations shifting towards no further rate cuts and a hawkish central bank we could see some shift in momentum by the consumer,” said Commonwealth Bank economists in a note to clients on Wednesday. Boxing Day sales might look a little different this year. Picture: iStock Consumers will go back into their shells a little, businesses might not hire quite so many staff for Christmas and Boxing Day sales, and the whole economy will trundle along at a slower pace than it would have otherwise. Which would be perfect. Just fine. If we weren’t also facing rising unemployment. The most recent data on joblessness shows that the unemployment rate just popped up from 4.3 per cent to 4.5 per cent, as the next chart shows. More Coverage Grim RBA truth spells disaster for Australia Jason Murphy Rate rise warning after inflation shock Cameron Micallef What you want, if you’re trying to solve unemployment, is low inflation. Because that lets the RBA cut rates. And the low rates inspire consumers to spend and businesses to hire. Things are not looking good. Picture: ABS Instead we are trapped in a bit of a corner, where there is little the RBA can do about rising unemployment because it has to make its first priority defeating persistent inflation. Things are going to get worse before they get better. Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology Join the conversation (199 Comments) Add your comment to this story To join the conversation, please log in. Don't have an account? Join the conversation, you are commenting as More related stories GPs slam new bulk-billing model The sweeping new changes come into effect this weekend, but a Sydney GP clinic has argued the bulk-billing model would harm both patients and clinics. Interest Rates Rate rise warning after inflation shock The conversation has changed on interest-rate relief on the back of Australia’s latest inflation figures, and mortgage holders won’t be happy. Australian Economy Major bank dashes interest rate hopes A big four bank warns Australia's inflation rate could surge to its highest level in months, forcing the RBA to abandon any plans for a November rate cut. Registration In The Know Quiz Newsletters Competitions Welcome to news.com.au Code of Conduct Help and Support General Feedback Advertise with us Standards of Practice Licensing & Reprints Our News Network The Daily Telegraph The Courier Mail Our Partners realestate.com.au CODE Sports A NOTE ABOUT RELEVANT ADVERTISING: We collect information about the content (including ads) you use across this site and use it to make both advertising and content more relevant to you on our network and other sites. Find out more about our policy and your choices, including how to opt-out.Sometimes our articles will try to help you find the right product at the right price. We may receive payment from third parties for publishing this content or when you make a purchase through the links on our sites. Privacy policy Relevant ads opt-out Cookie policy Terms of use Nationwide News Pty Ltd © 2025. All times AEDT (GMT +11). Powered by WordPress.com VIP More stories before you go